Petronet LNG to buy super-chilled fuel in 2024 to feed India's growing demand

Petronet LNG, the country's largest importer of liquefied natural gas (LNG) in India, is looking to buy the super-chilled fuel through a long term contract starting from 2024, according to a document reviewed by Reuters.

It has issued a Request for Information (RFI) indicating an interest to buy about 1 million tonnes per annum (mtpa) of LNG for 10 years starting from 2024, with the possibility to extend, according to the February 19 document.

A request for information is a common practice to ask for written information about the capabilities of various LNG sellers to help them make more informed buying decisions.

Petronet's Director of Finance Vinod Kumar Mishra declined to comment on the RFI.

Petronet's request comes amid a trend among LNG buyers to move away from long-term contracts with fixed pricing to shorter contracts with lower volumes and more flexible terms. However, Indian companies have sought longer contracts as they expect domestic gas demand to increase.

The cargoes will be bought on a price formula linked to both Henry Hub natural gas futures in the United States and Dutch TTF gas futures and shipped on a delivered ex-ship (DES) basis, the document showed.

Indian companies typically price their LNG contracts on an oil-linked basis while some are tied to the Henry Hub, two sources familiar with LNG imports into India said. Contracts priced on a TTF basis are rare, the sources added.

Petronet is asking for suppliers to provide information related to the delivery and pricing of cargoes as well as flexibility that the suppliers can provide, including volumes and destination, the document stated.

Suppliers must respond by February 26 and Petronet will shortlist the five most competitive suppliers.

The company will analyse supply offers as well as potential LNG terminal investments if required by the suppliers.

Petronet is already in talks with several companies including U.S. based Tellurian and NextDecade Corp to buy LNG.

It currently has long-term contracts with Qatar Petroleum and Exxon Mobil Corp to lift about 10 mtpa of supply.

India wants to raise the share of gas in its energy mix to 15% by 2030 from the current 6.2% to reduce pollution, including the capital New Delhi.

- 0

- Leave a comment

Big trade deal coming soon; talks are on: PM Modi

Prime Minister Narendra Modi, during a joint press briefing with US President Donald Trump, said India and USA would soon start talks on a big trade deal. "Our commerce ministers have had positive talks on trade. Both of us have decided that our teams should give legal shape to these trade talks. We also agreed to open negotiations on a big trade deal," said PM Modi.

Bilateral trade between the two countries had seen two-digit growth and increased trade stability in the last three years, he said.

President Trump, too, said that India and USA were at the peak of their relationship and expected that the countries would soon agree upon a comprehensive "trade deal". Trump on Monday had termed Modi a "tough negotiator" saying the two countries would sign one of the biggest trade deals. India and USA were supposed to sign a trade deal before Trump's visit, but both the countries failed to reach an agreeable deal.

During an interaction with reporters at the Joint Base Andrews outside Washington last week, Trump said, "Well, we can have a trade deal with India, but I'm saving the big deal for later on."

"We're doing a very big trade deal with India. We'll have it. I don't know if it'll be done before the election (in November), but we'll have a very big deal with India," he added. Trump, forcefully pursuing his 'America first' policy, has previously described India as a "tariff king" for imposing "tremendously high" tariffs on American products.

India is demanding exemption from high duties imposed by the US on certain steel and aluminium products, resumption of export benefits to certain domestic products under their Generalised System of Preferences (GSP), greater market access for its products from sectors including agriculture, automobile, auto components and engineering.

On the other hand, the US wants greater market access for its farm and manufacturing products, dairy items and medical devices, and cut on import duties on some ICT products. The US has also raised concerns over high trade deficit with India which was USD 16.9 billion in 2018-19.

Donald Trump announces mega $3 billion defence deal with India

Trump visits India: US President Donald Trump announced the United States would improve defence pacts with India. Speaking at the Motera Stadium in Ahmedabad on Monday, President Trump announced the US would sign a $3 billion defence deal with India on Tuesday. He said emphasised that the US would become India's premier defence partner.

"I'm pleased to announce that tomorrow our representatives will sign deals to sell over $3 billion, in the absolute finest state of the art military helicopters and other equipment to the Indian armed forces," Trump said.

"As we continue to build our defence cooperation, the US looks forward to providing India with some of the best & most feared military equipment on the planet. We make the greatest weapons ever made. We make the best and we are dealing now with India," he added.

Key aspect of the defence deal on Tuesday is expected to be the purchase of MH-60 multi-role helicopters for Indian Navy. The acquisition was approved by the Cabinet Committee on Security last week. The government-to-government deal involves acquisition of 24 MH-60R Seahawk maritime helicopters from the US-based Lockheed Martin group. The MH-60Rs will be purchased directly from the US government under a Foreign Military Sales (FMS) agreement with the US Department of Defence (DoD). The deal, valued at $2.6 billion, was approved in August 2018 by then Defence Minister Nirmala Sitharaman. The US Department of State gave its approval in April 2019.

The MH-60s, which are currently deployed with the US Navy, are considered to be the most capable naval helicopters available today. They are capable of conducting highly efficient reconnaissance missions and have been designed to hunt down submarines and will add to the strategic depth and combat capability of the Indian Navy. The fleet will boost the Indian Navy's anti-surface and anti-submarine warfare operations.

The MH 60 multi-role Romeo Sikorsky helicopters will replace ageing British-made Sea King helicopters. The first batch of MH-60 Romeo helicopters is scheduled to be delivered by Lockheed Martin within two years. The multi-role helicopters will be deployed on warships and will be very effective in keeping the submarine threat posed by the extra-regional Navies, including China and Pakistan, in the Indian Ocean Region. These helicopters will be used in Anti Submarine Warfare (ASW), Anti Surface warfare (ASuW), Command and Control, ESM roles besides Search and Rescue (SAR), Vertical Replenishment (VERTREP) roles, etc.

Manmohan Singh calls $5 trillion economy target 'wishful thinking'

Former prime minister Manmohan Singh has said Modi government doesn't acknowledge the word "slowdown" and warned of real dangers if corrective action will not be taken on time.

"...we have today a government that does not acknowledge that there is such a word as slowdown. I think this is not good for our country," Singh, while addressing a gathering at the launch of Montek Singh Ahluwalia's book 'Backstage: The Story behind India's High Growth Years', said. He also cited the former Planning Commission's observations to state that achieving the $5 trillion economy by 2024-25 was just "wishful thinking".

He said the current dispensation at the Centre didn't recognise the real dangers to the economy. "If you do not recognise the problems that you face, you are not likely to find credible answers to take corrective action. That is the real danger," Singh said.

Talking about Ahluwalia's book, Singh said just like achieving $5 trillion economies by 2024 was "wishful thinking", one could also not believe on the government's claim of doubling farmers' income. "Montek has also pointed out that contrary to what the ruling group may say, today the USD 5 trillion economy by 2024-25 is wishful thinking. Also, there is no reason to expect that farmers' income will be doubled in a three-year period," he said.

He said there's a need for bold and new reform measures. "I do believe that there is a need for re-thinking of the reform process fresh. The second generation of reforms requires new pathways and these new pathways can emerge only with a solid discussion of the alternatives," Singh said.

Singh, who has been a staunch critic of the Modi government, in November said the state of Indian economy was in quite a bad shape. He added a sharp dip from 5 per cent in the first quarter to 4.5 per cent in the second was worrisome.

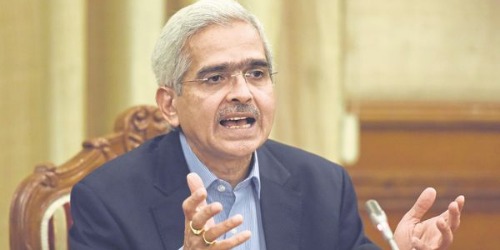

Transmission of policy rate cuts steadily improving: Shaktikanta Das

A customary post-budget central board meeting was held by the Reserve Bank of India on Saturday. The meeting was attended by Finance Minister Nirmala Sitharaman, RBI Governor Shaktikanta Das, MoS Anurag Thakur, and other RBI board members and government functionaries.

In the meeting, RBI Governor Das stated that the transmission of policy rate cuts has improved by 69bps and that momentum was gathering pace on credit growth.

On February 6, Das-led Monetary Policy Committee (MPC) maintained status quo in its latest policy announcement, in wake of rising inflation. The MPC, kept the repo rate unchanged at 5.15 per cent, for the second consecutive time this fiscal.

Prior to going for status quo on rates in December, the central bank had slashed rates five consecutive times that resulted in a cumulative 1.35 per cent decline in repo rate.

The Governor forecasted growth at 6 per cent for FY 21, which was in line with Economic Survey projection.

"We have given growth projection of 6 per cent for the next year, which is in line with Economic Survey projection," Das added.

He also stated that the Monetary Policy Framework was in operation for last three years. Das said that RBI would try to maintain enough liquidity for productive sector in the economy.

"Monetary Policy Framework is in operation for the last three years. Internally, we are reviewing and analysing how the MPC framework has worked. At an appropriate time,if required, we'll have dialogue and discussion with the government. At the moment it is under review within RBI".

The central bank governor also stated, "For greater transparency, RBI board meeting minutes will be uploaded on website".

On AGR dues, Das said that RBI was examinimg the case.

"I don't want to comment on it either this way or that; it's an internal matter which will be examined by the RBI".

Meanwhile, FM Sithraman on agricultural credit target said, "We expect the demand to grow and the credit requirements to meet up with it". The FM said that she was closely monitoring banks and their extension of credit facility, particularly to the rural areas.