India's unemployment rate rises to 7.7% in December

India's unemployment rate increased to 7.7 per cent in December, slightly higher than 7.48 per cent reported in the previous month, according to data released by think-tank Centre for Monitoring Indian Economy (CMIE) on Thursday. In November, the unemployment rate had fallen nearly 1 per cent to 7.48 per cent compared to a three-year high of 8.45 per cent in October 2019.

According to CMIE, the urban unemployment rate rose by a fraction from 8.89 per cent in November to 8.91 per cent in December 2019. The urban unemployment numbers were higher than the national average, reflecting a decline in economic activity in the country. India's Gross Domestic Product (GDP) growth has slipped below 5 per cent in the last two quarters as weak demand and slump in investment continue to weigh on the country's economic growth momentum.

In rural India, the uptick in unemployment rate was sharper from 6.82 per cent in November to 7.13 per cent in December.

Six out of India's 10 states with the highest unemployment rate are either ruled by the BJP or it is an alliance partner with regional parties. Tripura, Haryana and Himachal Pradesh witnessed highest unemployment levels of more than 20 per cent, while Karnataka and Assam reported lowest unemployment rate of 0.9 per cent each. Tripura remained the state with highest unemployment rate of 28.6 per cent, followed by Haryana with 27.6 per cent.

Delhi saw its unemployment rate falling sharply to 11.2 per cent in December as compared to November's figure of 16 per cent. The agency noted that the unemployment rate in national capital has hit the lowest level since December 2018.

In December 2019, top 5 states/UTs with highest unemployment rates were Tripura (28.6 per cent), Haryana (27.6 per cent), Himachal Pradesh (20.2 per cent), Jharkhand (17.7 per cent) and Rajasthan (15.9%). Bihar and Uttar Pradesh have unemployment rates of 11.1 per cent and 9.4 per cent, respectively.

The states with the lowest unemployment rate in December were Karnataka (0.9 per cent), Assam (0.9 per cent), Telangana (2.2 per cent), Meghalaya (2.5 per cent) and Sikkim (3.3 per cent). Madhya Pradesh, Maharashtra and Gujarat have unemployment rates of 3.9 per cent, 4.7 per cent and 4.4 per cent, respectively.

- 0

- Leave a comment

SBI gives New Year gift to home, car buyers! Cuts external benchmark rate on loans by 25 bps

State Bank of India (SBI) on Monday announced a reduction in its external benchmark based rate (EBR) by 25 basis points to 7.80 per cent from 8.05 per cent. The new rates will be applicable from January 1, 2020.

"With this reduction, interest rate for existing home loan customers as well as MSME (micro, small and medium enterprises) borrowers who have availed loans linked to external benchmark based rate would come down by 25 bps," the country's largest lender said in a release.

SBI also said that new home buyers would now be able to get loans at an interest rate of 7.90 per cent per annum as compared to the earlier 8.15 per cent.

Banks are required to alter the external benchmark based rate at least once in three months depending on underlying external rate like repo rate.

SBI's external benchmark lending rate is linked to RBI's repo rate which is currently at 5.15 per cent. The rate is fixed at repo rate plus 265 basis points. In October the RBI had cut its repo rate by 25 bais points to the current 5.15 per cent.

Earlier this month, the State Bank of India had announced a cut in marginal cost of funds-based lending rate (MCLR) by 10 bps for its 1 year MCLR. The revised rates came into effect from December 10. That was the eighth consecutive cut in MCLR this fiscal.

SBI is the largest commercial bank in India. It also has a market share of 25 per cent each in home loans and auto loans, it stated.

Commercial real estate to continue its boom in 2020; residential sales may see growth only in H2

The year 2019 was a mixed one for the real estate industry. And it is likely to be the same in 2020, or for most months during the year. While developers continue to sound optimistic, not all is well -- particularly in the residential market.

First, the bright spots. Commercial, or office real estate boomed in 2019 and is likely to further bloom in 2020. The supply is steadily increasing, so has the absorption rates. Vacancies are down for the top grade buildings while rents in many markets have risen. Unlike the residential side, the office market is characterised by transparency, and in most cases, on-time delivery. Rents could inch up because there is limited ready-to-move-in supply in major markets. Companies looking for larger spaces, of say half a million sq ft, are pre-committing to developers that are starting work now.

Commercial, as also the logistics real estate, would also be buoyed by the depth of India's economy over the mid-term. In 2019, India became a $2.7 trillion economy and now wishes to touch $5 trillion by 2024-25. Logistics real estate is likely to see heavy investments in tech-enabled warehouses -- concrete or low quality steel godowns are now being replaced by steel structures, which are pre-engineered in factories and then assembled at the location. The way India stores is changing, particularly, after GST was enforced in 2017. Fast moving consumer goods companies, consumer durable and other manufacturing firms are consolidating smaller warehouses across multiple states, set up to be tax efficient, into a few strategic but large ones considering India is now a single tax country. From managing single company warehouses, logistics companies are shifting to multi-client, multi-product models.

So, what about residential real estate? The second half of 2019 didn't have encouraging news to forecast a stronger first half of 2020. ANAROCK Property Consultants cited "unrelenting liquidity crisis, lower-than-expected buyer sentiments and faltering GDP growth" as reasons for poor housing growth. Of the 2.61 lakh housing sales in 2019 across the top seven cities, over 56 per cent were sold in the first half itself. Residential sales in the second half of 2019 plummeted 22 per cent against the first half of the year. ANAROCK added that on the supply front, of the 2.37 lakh units launched in 2019, the second half had new addition of 97,000 units as against 1.4 lakh units in the first half.

"Residential growth in 2020 will mainly depend on the swift on-ground implementation of some of the previously-announced sops including stressed funds (of Rs 25,000 crore). If not, it may negatively impact the sector with buyer sentiments derailing even further. And if done timely, these measures will yield positive impact on the Indian real estate in 2020. A major part of the residential growth will most likely unfold in the second half of 2020. And, the financially stronger players will stay ahead in the game," Anuj Puri, Chairman, ANAROCK Property Consultants, noted.

One segment of the residential market that could witness and sustain some momentum is affordable housing. In 2019, overall new supply in the segment rose 22 per cent -- from 77,590 units in 2018 to nearly 94,530 units in 2019.

Yet another trend to watch in 2020 would be rental housing. Parveen Jain, CMD of Tulip Infratech & Vice Chairman of industry body NAREDCO says that metropolitan places like NCR are becoming a popular destination for renting as it comprises global cities like Delhi and Gurgaon and their expanding subsidiary towns. "As masses from far-off places and other states converge here in search of jobs at all levels and for amenities available here, the demand for housing, and in turn, for staying on rent is ever increasing in the NCR area," he noted.

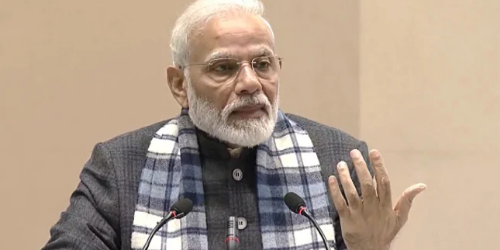

India will emerge stronger from economic slowdown, says PM Modi

Indian will emerge stronger from an economic slowdown, Prime Minister Narendra Modi said in a speech on Friday, reassuring investors about their long-term bets on Asia's third-biggest economy.

India, once the poster child of economic growth in the developing world, grew at the slowest pace in six years during the July-September quarter.

"India has witnessed such ups and downs previously as well," Modi said in a Hindi speech to businesses leaders in capital New Delhi. "And each time, we have emerged even stronger. That's why even now India will forge its path ahead with firmer determination and confidence."

The federal government will spend 100 trillion rupees ($1.4 trillion) in the coming years to develop the country's infrastructure further, Modi said.

BJP offers platform parallel to Finance Ministry for pre-budget consultations

Bharatiya Janata Party (BJP) has initiated a stakeholders' dialogue as part of pre-budget consultations. This comes alongside Finance Minister Nirmala Sitharaman's official stakeholder interactions.

"Annual Budget making is an important exercise which impacts economic roadmap ahead. Any feedback and suggestion that helps the Party and the Government to increase its connect with the ground realities are welcome. As a ruling political party, it is always our endeavor to interact with stakeholders on important policy decisions of the government," Gopal Krishna Agarwal, national spokesperson for economic issues, BJP, said.

The stakeholders' dialogue with BJP, which started on Thursday, will go on till 14th January 2020. The 11 sectoral dialogues will cover areas like GST, agriculture, MSME, real estate, pharma, heavy industries, telecommunication and IT, financial sector, and macro economy in general.

While the GST session will cover IBC and Company Law implementation, agriculture will include supply chain, input cost and crop insurance, food processing, procurement, trading, exports and trade relations etc. Under MSME, issues related with credit, working capital, compliance, GEM, TReads and startup ecosystem will be discussed.

According to Agarwal, the topic real estate and construction will look at issues related to RERA, home buyers and employment generation. Automobile industry will be in focus along with intellectual property rights and industry standards related issues of the pharmaceutical industry. Heavy industries sessions will cover land, labour and contract enforcement. Telecommunication and Information Technology will include IT enabled services, ecommerce, data privacy and competition scenario. The discussion on financial sector will touch upon financial resolution, cooperatives banks and NBFCs. Finally, the Micro and Macro economy session will discuss GDP growth, capital information, investment, sentiments and consumer demand.

Invited sectoral experts and office bearers of associations will be part of the dialogue.

While the consultations are being held with Agarwal and other general secretaries, the reports from these consultations, after deliberation with BJP President J.P. Nadda and general secretary B.L. Santosh will be forwarded to the central government.