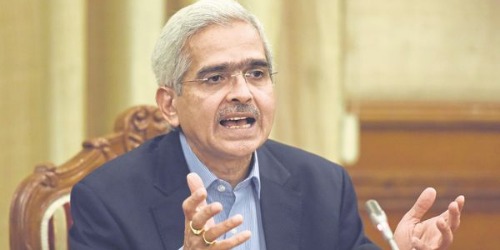

Transmission of policy rate cuts steadily improving: Shaktikanta Das

A customary post-budget central board meeting was held by the Reserve Bank of India on Saturday. The meeting was attended by Finance Minister Nirmala Sitharaman, RBI Governor Shaktikanta Das, MoS Anurag Thakur, and other RBI board members and government functionaries.

In the meeting, RBI Governor Das stated that the transmission of policy rate cuts has improved by 69bps and that momentum was gathering pace on credit growth.

On February 6, Das-led Monetary Policy Committee (MPC) maintained status quo in its latest policy announcement, in wake of rising inflation. The MPC, kept the repo rate unchanged at 5.15 per cent, for the second consecutive time this fiscal.

Prior to going for status quo on rates in December, the central bank had slashed rates five consecutive times that resulted in a cumulative 1.35 per cent decline in repo rate.

The Governor forecasted growth at 6 per cent for FY 21, which was in line with Economic Survey projection.

"We have given growth projection of 6 per cent for the next year, which is in line with Economic Survey projection," Das added.

He also stated that the Monetary Policy Framework was in operation for last three years. Das said that RBI would try to maintain enough liquidity for productive sector in the economy.

"Monetary Policy Framework is in operation for the last three years. Internally, we are reviewing and analysing how the MPC framework has worked. At an appropriate time,if required, we'll have dialogue and discussion with the government. At the moment it is under review within RBI".

The central bank governor also stated, "For greater transparency, RBI board meeting minutes will be uploaded on website".

On AGR dues, Das said that RBI was examinimg the case.

"I don't want to comment on it either this way or that; it's an internal matter which will be examined by the RBI".

Meanwhile, FM Sithraman on agricultural credit target said, "We expect the demand to grow and the credit requirements to meet up with it". The FM said that she was closely monitoring banks and their extension of credit facility, particularly to the rural areas.

- 0

- Leave a comment